As per the RBI guidelines, banks can fund up to 100% of the overseas trade purchase, including freight costs, over a period of up to 360 days from the date of shipment in the case of raw material and 3 years in the case of Capex transaction. The financing is done in foreign currency at SOFR (Secured Overnight Financing Rate) related rates which lower down the cost significantly.

Following are the two products we offer to finance imports:

Supplier’s Credit

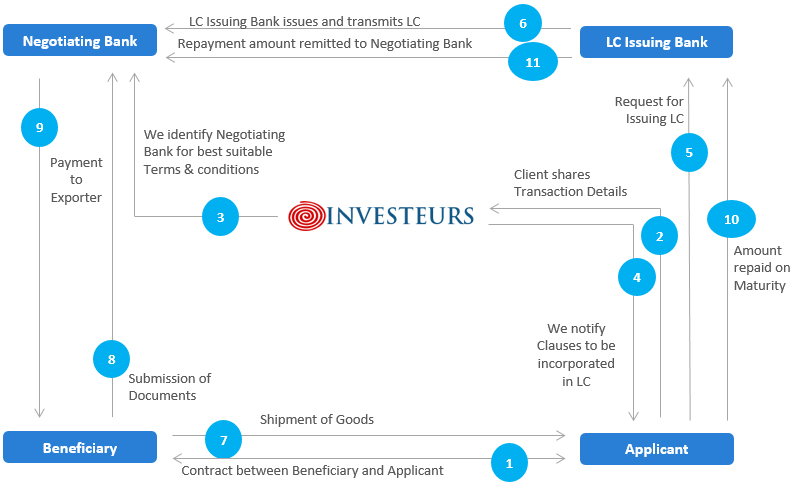

Supplier’s Credit is a facility of arranging funds for importers using bank risk (keeping LC as an underlying asset). This credit facility is extended to importers for imports into India by overseas suppliers or Financial Institutions. Letter of Credit issued by Indian banks under Usance Bills on behalf of their importers is discounted by Indian bank branches situated overseas or foreign banks.

We have ensured payment to suppliers at different counters around the globe. We have handled/executed transactions via both “Negotiation and Reimbursement route”.

Negotiation Route:

- Pre-Acceptance: Under this route, the financing bank will add the confirmation to the LC. The supplier has the ease to get the documents discounted upfront from a bank in his own country upon presentation of credit- compliant documents, as per the LC terms. This route may be used wherein the supplier is at a dominant or monopolistic position.

- Post-Acceptance: Under this route, the supplier will be paid by the financing bank after receipt of acceptance from the LC Issuing Bank. The supplier’s bank will submit the documents to the financing or negotiating bank for negotiation. The negotiating bank will send the documents to the LC Issuing Bank for Acceptance. This route may be used where the seller has trust over the buyer and the buyer is in a dominant position

Reimbursement Route:

- This is the most widely used payment method in Import LC. Under this route, the buyer has the benefit of getting the documents discounted from any part of the globe without having to send the documents to the Reimbursing Bank. The buyer and seller both have an advantage of timely receipt of documents and payment, respectively.

Process flow for Supplier’s Client:

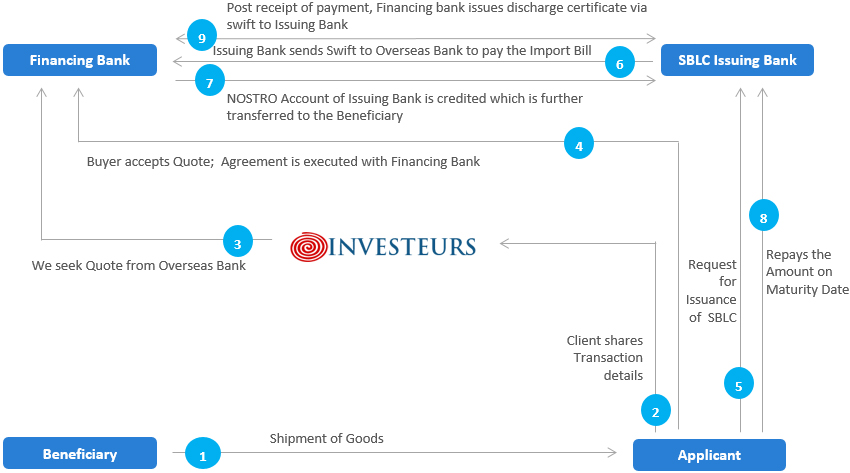

SBLC-backed Buyer’s Credit

An SBLC-backed Buyer’s Credit is an instrument that guarantees a Bank’s Commitment of Payment to a Seller in the event that the Buyer defaults on the agreement. SBLC-backed Buyer’s Credit refers to loan for payment of imports into India arranged on behalf of the importer through an Overseas Bank.

The importer may choose to avail financing in Foreign Currency after the shipment is done by the supplier.

Process flow for SBLC backed Buyer’s Credit:

Our Services

- We maintain an MIS of our clients and update them periodically.

- Updation of transaction, like, documents status, acceptance status, payment date (as per LC terms), payment status.

- We provide Payment Copies (MT 202) and Interest advices (MT 799) to them once payment is done.

- Ensuring payment to financing bank on maturity date.

- Maintenance of key documents like Bill of Exchange, LC copy, etc.

Investeurs Effect: